|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

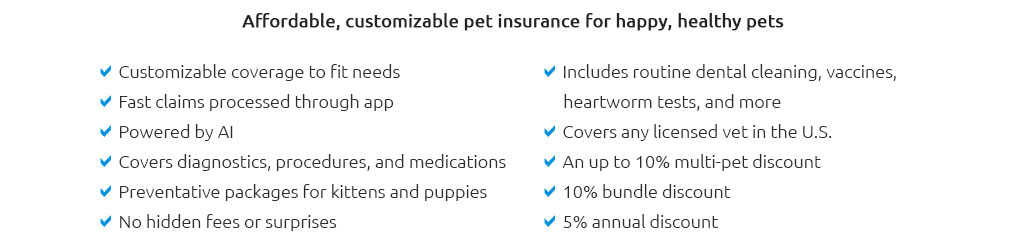

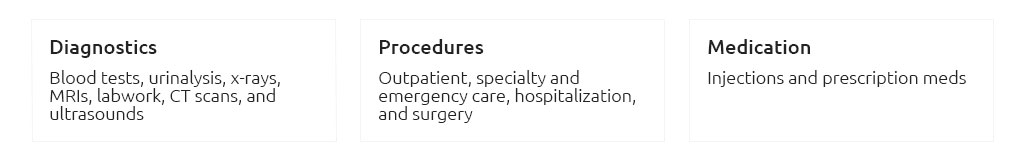

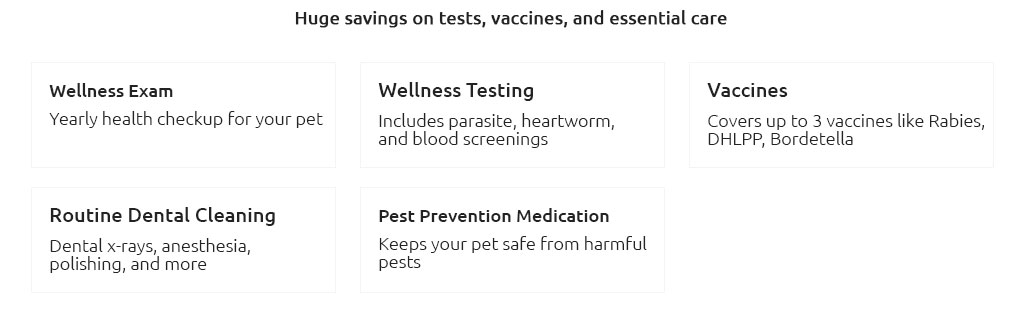

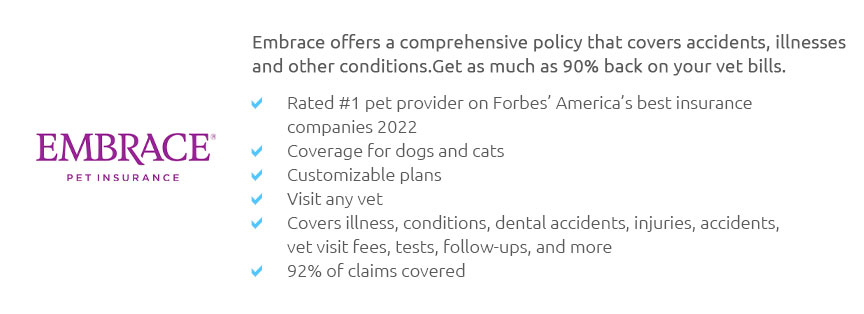

Understanding the Cost of Pet Insurance: An In-Depth AnalysisIn recent years, the concept of pet insurance has gained significant traction, mirroring a broader societal shift towards safeguarding the health and well-being of our beloved animal companions. As more households welcome pets into their lives, the question of whether or not to invest in pet insurance becomes increasingly pertinent. To truly understand the cost associated with pet insurance, one must delve into the various factors that influence pricing, the types of coverage available, and the potential benefits and drawbacks of such an investment. Pet insurance costs can vary dramatically based on several key elements, including the species and breed of the pet, their age, and even the geographic location of the owner. For instance, insuring a pedigree dog often comes with a higher premium compared to mixed breeds due to the genetic predispositions to certain health conditions that pedigrees commonly face. Similarly, an older pet might incur greater costs due to the increased likelihood of health issues that accompany aging. Geographic location also plays a crucial role, as veterinary costs are generally higher in urban areas compared to rural settings, which subsequently affects insurance premiums. Another important consideration is the type of coverage selected. Generally, there are three main types of pet insurance plans:

It is worth noting that while the initial cost of pet insurance might seem steep, it can potentially save pet owners from exorbitant veterinary bills in the long run. Take, for example, the story of Max, a six-year-old Labrador whose owner, Sarah, faced an unexpected medical emergency when Max developed a severe case of pancreatitis. The treatment costs quickly escalated to several thousand dollars. Fortunately, Sarah had invested in a robust insurance plan that covered the majority of the expenses, offering her financial relief and peace of mind. Such real-world examples underscore the potential financial protection that pet insurance can provide, especially in unforeseen circumstances. However, pet insurance is not without its critics. Some argue that the cost of premiums, deductibles, and co-pays can sometimes outweigh the benefits, especially for pets that remain healthy throughout their lives. Moreover, certain policies may exclude pre-existing conditions, leaving pet owners with uncovered expenses. It's crucial, therefore, for potential policyholders to meticulously scrutinize policy details, compare different insurance providers, and consider their pet's specific needs and medical history before committing. Ultimately, the decision to purchase pet insurance is a personal one, contingent upon individual circumstances and risk tolerance. While it is an additional expense, many pet owners find value in the security it offers, equating it to a safety net that allows them to make decisions based on their pet's best interests rather than financial constraints. In an ever-evolving market, the availability of customizable plans and competitive pricing continues to make pet insurance an accessible and worthwhile consideration for pet owners looking to safeguard the health and happiness of their furry family members. https://www.petmd.com/general-health/how-much-does-pet-insurance-cost

Average Costs of Pet Insurance. The average cost for pet insurance is $10$53 per month, or $122$640 annually. There are several elements of ... https://www.bankrate.com/insurance/pet-insurance/how-much-does-pet-insurance-cost/

Pet insurance costs depend on your pet, where you live, the plan you choose and several other factors. https://www.metlifepetinsurance.com/blog/pet-insurance/how-much-does-pet-insurance-cost/

As of 2024, the average monthly premium for dog insurance that covers accidents and illnesses has increased to $53 per month.

|